China's Space Lasers (Part 2)

Findings from a couple of weeks of digging into China's space-based laser comms sector

Dear Readers,

A slightly different type of post today, as I share some insights from our recently-completed China Space-Based Laser Communications Report, July 2025 Update.

Tracking China’s Space Industry Supply Chain

There are only so many satellites and rockets being launched from China, and it’s not very difficult or interesting to only identify who is building the satellites (though this can sometimes be more challenging than one might think).

That being the case, a few years ago we began building out our China Supplier Database, which now stands at some 12,000 data points of suppliers of components or systems on launched satellites and rockets (get in touch for pricing info on the full database). It’s a topic that I touched on in an article last year, and the general takeaway is that China’s space industry supply chain is getting a lot more diverse, very quickly. And perhaps nowhere is that clearer than in laser communications, where we’ve seen around a dozen companies pop up since 2020.

After a Late Start, Now Moving at the Speed of Light

The dawn of China’s commercial space sector was 2014, and by and large, the earliest companies to receive funding were companies building systems-level things: satellites and rockets. With no commercial satellite manufacturers before that time, there was no need for commercial component and subsystem manufacturers. And with no commercial constellations, there were no commercial companies talking about making lasers (or thrusters, or star trackers, etc.).

As a result, it took a little while for venture capital money to start trickling down to the components and subsystems companies, and this was true in laser communications too.

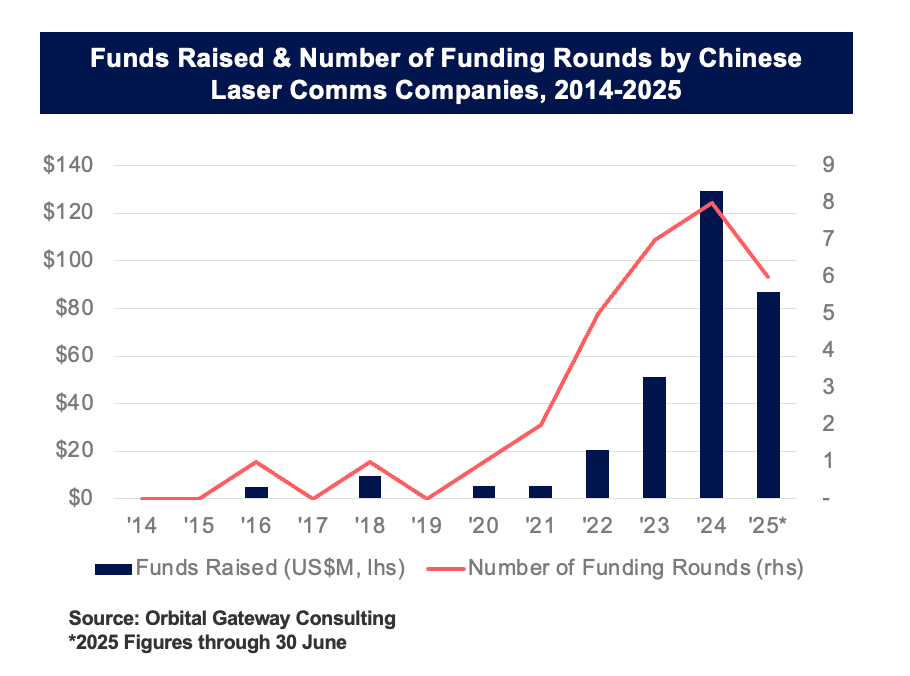

Up until the end of 2019, there were only two funding rounds in China for companies developing space-based laser comms technology, with both rounds being Intane Optics, a pioneer in China’s laser communications sector.

How times have changed. Since the beginning of 2020, we have seen 33 funding rounds by space laser comms companies in China, and since the beginning of 2023, there have been 24 rounds. Funding raised tells a similar story, with ~US$313M raised since 2014, of which US$267M has come since beginning of 2023. And while 2024 was clearly a banner year with ~US$130M of money thrown at laser companies, 2025 is shaping up to be even bigger, with >US$80M raised in the first half of the year.

What gives? Why the sudden avalanche of funding for laser communications companies? At least three reasons:

China’s non-geostationary comms constellations (“Chinese version of Starlink”) have begun to take shape, and this represents a major demand driver for laser comms terminals (LCTs).

China has run into difficulties in setting up overseas ground stations. This makes it more challenging to downlink data from certain regions very quickly, a challenge that can be mitigated with laser inter-satellite links.

China continues to push for the “integration of remote sensing, communications, and navigation satellites” (通导遥一体化), a prospect made somewhat simpler by having a robust LCT industry.

An Industry Beginning to Emerge

And so here we are, with ~12 commercial companies having emerged from several major Chinese Academy of Sciences (CAS) institutes, universities, and SOEs. The landscape can broadly be divided into several categories:

The National Team: this being fully state-owned entities, the “old guard” of China’s space-based laser comms sector. Included here are major subsidiaries of CAST, CASIC, CETC, and several branches of the Chinese Academy of Sciences (CAS) Institute of Optics and Precision Mechanics.

The Big Four Commercial Players: including the above-mentioned Intane Optics, HiStarlink, Laser Link, and Laser Starcom. The latter three have all raised >US$50M, and were all established after 2020

The Commercial Up-and-Comers: an eclectic mix of companies building LCTs, optical filters for LCTs, and other supporting components. Most of these companies have been around for ~2-4 years, and are working with some of the Big Four as partners or suppliers

The New CAS Spinoffs: the CAS has invested into several new commercial LCT companies, including the very creatively named CAS Optical Communications Company. These companies are in some sense dark horses in China’s LCT race: they’re some of the newest ones, but their CAS heritage and substantial technology support should allow for rapid development.

The Path Forward

China’s LCT manufacturers are all aiming for the biggest prize: supplying LCTs to the country’s NGSO comms constellations. With that said, some have been more deliberate than others. During our research for this report, we spoke with one LCT manufacturer who was originally angling to sell their terminals abroad.

After winning some state contracts, they decided that it would put them in a stronger position domestically if they did not have any international business, and so their international expansion plans were shelved.

On the other hand, another LCT manufacturer that we spoke to had established a subsidiary in Singapore, and was trying to sell into non-space markets (mining, telcos) in addition to space, both inside and outside of China.

The industry is also on the cusp of possible oversupply, with several companies planning to debut production lines with annual manufacturing capacity of thousands of LCTs. Some will win contracts with the big constellations, soaking up supply, but some will not, begging the question of where do they dump those LCTs?

A lot more to come from this space. For the full breakdown, get in touch for more information and a price quotation for the China Space-Based Laser Communications, July 2025 Update report from Orbital Gateway Consulting.

Thanks for reading, and be on the lookout in the next few weeks for a H1 2025 summary article, available to our paid subscribers.

Happy Weekend All,

Blaine