Review in Chinese Space: January to April

Plus details on CGSTL's manufacturing costs 🏭, China's first SAR payload readies for export 🛰️, and a crazy detailed analysis of remote sensing data contracts 📷

Dear Readers,

A happy Thursday to all. Interesting few weeks with China’s first export-oriented SAR payload passing review, CGSTL revealing details about manufacturing costs, and a more…behind the paywall. But for everyone’s reading pleasure, first we dig into the year that has been thus far in Chinese space, with a breakdown of the first 4 months of 2025, and how it compares to previous years.

An unsurprising drop in total funding, but funding rounds remain robust

Chinese space industry funding in the first 4 months of 2025 dropped substantially compared to last year, though 2024 was a unique case with SpaceSail raising ¥6.7B (US$950M), accounting for >80% of the total by end of April.

At our parent company Orbital Gateway Consulting, we track Chinese space industry funding by making high and low estimates for each round, averaging them and yielding a midpoint estimate. In the first 4 months of 2025, the midpoint estimate for funds raised was ¥2.7B (US$375M) across 23 rounds, this compared to ¥8.2B in first 4 months of 2024 across only 14 rounds.

When looking at the change by vertical, a few trends emerge:

First, obviously the one big SpaceSail round dominates the 2024 data. The “Chinese version of Starlink” raised a billion dollars early last year, exceeding the total from January - April 2025 by a factor of >2x

Launch has become hot again. China’s commercial launch sector has gone through fits and starts since opening up in 2014, and for the few years between ~2021-2023, funding was pretty pedestrian. Launch has roared back in H2 2024 and early 2025. Why? Because SpaceSail raised a billion dollars to launch a Chinese version of Starlink, and launch remains a big bottleneck for their deployment. As a result, early 2025 saw several very big launch funding rounds, including Deep Blue Aerospace (nearly ¥500M), iSpace (“hundreds of millions” of Yuan), and relative newcomers RSpace (making fuel tanks, more than ¥100M raised), Astronstone (stainless steel rockets, “tens of millions” of Yuan), and Space Tech (more than ¥100M).

Satellite manufacturing has seen substantial growth, with this driven by two types of funding: 1) companies that build satellites, and 2) companies that build critical components, primarily for communications satellites. In the first camp, we have companies such as Hongqing Technology, which is building satellites for their own constellation, and more likely for the state-backed megaconstellations. In the second camp we have upstream companies such as Ubinexus, which is focused on building communications payloads for broadband satellites. Other upstream firms raising money include Thermal AI (thermal systems) and Exa Tech (onboard computers).

When looking at where the funding is coming from, the first few months of 2025 have seen an undeniable trend: provincial and city governments pouring money into the sector. A full 62% of funding raised so far this year has come from provinces and cities, with private investment accounting for about 20% and central government funds around 17.5%. Several big rounds were completely local funding, including Exa Tech (Chengdu Development Fund), Deep Blue Aerospace (city government of Taishan), iSpace (Sichuan Province Development Fund), and RSpace (Beijing City Commercial Space and Low-Orbit Economy Industrial Investment Fund, Beijing New Materials Industrial Investment Fund).

This largely mirrors the first few months of 2024, which also saw provincial government pony up the lion’s share of funding (58%, though again, the majority of funding was a single round of SpaceSail, who raised much of their money from the Shanghai Government). This reflects two trends: 1) the central government making it clear in late 2023 that the race to launch China’s version of Starlink was a wide open one, with commercial participants welcome, and 2) the tendency of provincial governments to support such national proclamations through investment.

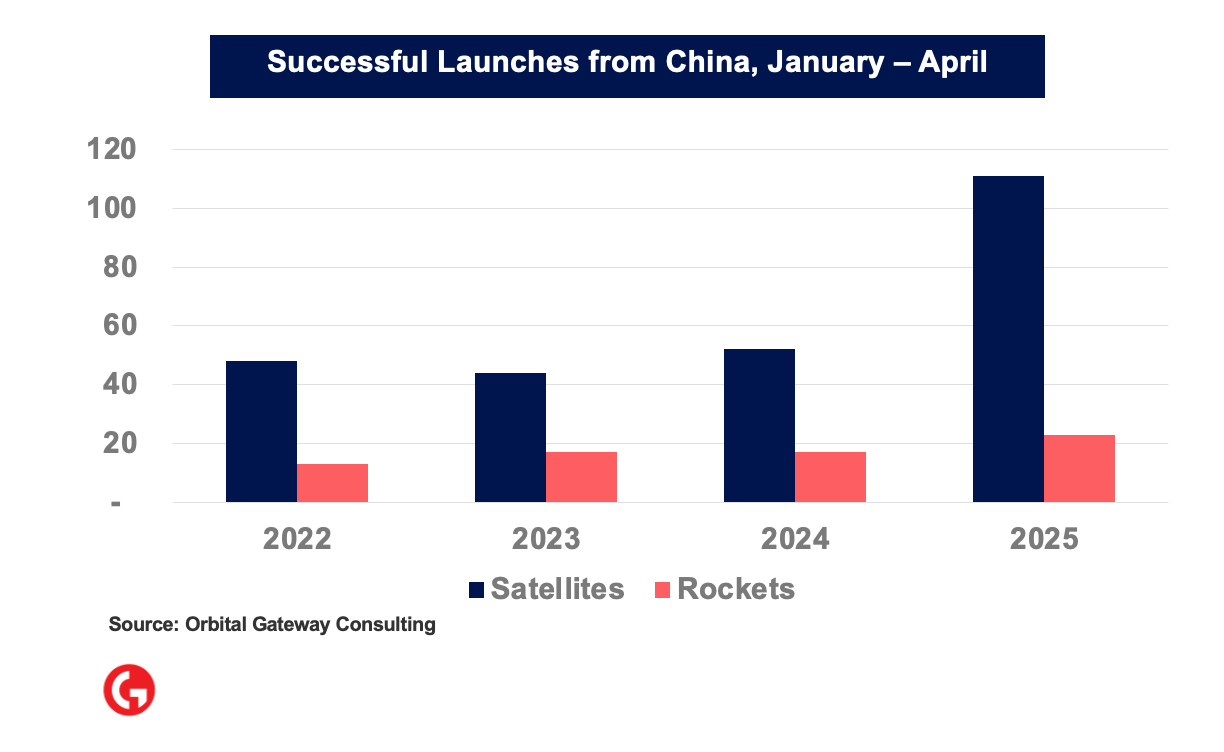

A record-setting 4 months in launch

2025 has been the biggest year ever, by far, in terms of Chinese launch activity. The first 4 months of this year have seen more launches than ever before (23, compared to 17 last year and the year before), but they’ve also seen far more satellites per rocket, indicative of bigger batches of satellites being launched. Thus far in 2025, we’ve seen more than twice as many satellites launched as in any previous year, with 111 sent to orbit on those 23 rockets compared to 44 and 52 in ‘23 and ‘24, respectively.

The biggest drivers of this increase, unsurprisingly, are China’s NGSO communications constellations. Just under half (55 of 111 satellites) came from Thousand Sails/G60 and SatNet/Guowang, with the former launching 2 batches of 18 satellites each, and the latter launching batches of 9 and 10 satellites in February and April, respectively.

But it has not only been these two constellations. Future Navigation launched a batch of 10 CentiSpace enhanced GNSS satellites in January, and meteorological constellation Yunyao Yuhang has been extremely active, launching 16 satellites in batches of 4, 6, and 6.

Moving forward, we should expect to see a busy second half of the year, with more batches for more constellations expected to be launched. Just yesterday, the first 12 satellites of the “Three Body Computing” constellation were sent to orbit, a likely sign of things to come…